By: Veena S

May 9 2020

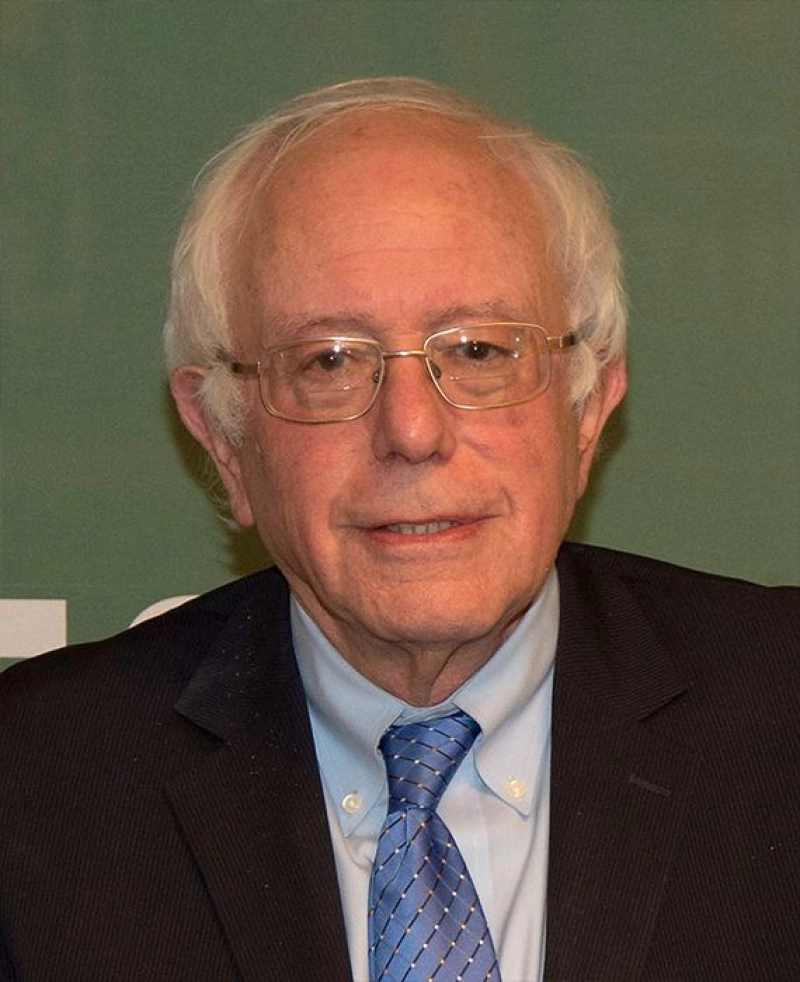

False: U.S. Senator Bernie Sanders' health care plan proposes to raise the tax rate to 52% on incomes over $29,000.

The Verdict False

A document showing the Income-tax rate on health care published on Senator Bernie Sander's website refutes the claim.

A document showing the Income-tax rate on health care published on Senator Bernie Sander's website refutes the claim.Bernie Sanders has proposed an Income Tax plan on health care program, 'Options to Finance for Medicare for All'. He says there are varieties of options available to support Medicare for All, which is a single-payer health care system. 'Options to Make the Wealthy Pay Their Fair Share', is one such way, under which he has proposed progressive income tax rates for various income slabs. The marginal income tax rate under the plan for income above $10 million will be 52 per cent. Thus it is evident that Sanders didn’t call for a 52% income tax rate for those making $29,000 and above.